Why We Believe Paper Stocks Have Multibagger Potential: An In-Depth EIC-Investment Analysis of West Coast Paper Mills Limited

It's all due to three things: demand, demand, and demand. This demand arises for various reasons, whether it's the plastic ban, the growing e-commerce trend, or increasing literacy rates. As we analyze this company, we've uncovered numerous interesting and compelling insights about the industry. Today, we will conduct an analysis of this industry and findout the best stock for you to invest in for the long term.

Story:

When it comes to reusing or recycling, I feel that Indians have always had a tendency to be one step ahead. In the early 14th century, we all know of the great Indian scholar "Saint" Kabir Das, who was also a significant figure in the "Bhakti Movement" in India. He used to write his verses on paper made from cotton rags. When he felt that his words were no longer needed, he would wash off the ink from the paper, leaving behind clean sheets. This practice of reusing paper can be considered a primitive form of paper recycling. Today, India has become a world leader in recycling paper products(71% of raw material in the Indian paper industry comes from recycling).

In recent years, due to the rapid increase in industrial development, the demand for paper and paperboard has surged. Almost all companies in the industry are making capital expenditures and trying to keep up with the rising demand. Issues like deforestation and water scarcity have made the competition fierce. Therefore, large players may have the advantage of expanding their capacity at their existing locations compared to new entrants.

Today, we have selected a stock from the Paper Industry, namely "West Coast Paper Mills," one of India's leading paper mills. When the company was established in 1955, the government agreed to provide them with bamboo at highly concessional rates for paper production for 30 years. However, the company has now completely shifted its focus from bamboo to hardwood. For your information, the paper production process includes steps such as pulping wood fibers, refining and cleaning the pulp, forming sheets, pressing and drying, and finally, cutting and packaging the paper.

India's per capita paper usage is only 15 kg, far below the global average of 57 kg, signaling substantial growth potential.

- West Coast Paper benefits from its strategic location in "Dandeli" and a strong network of over 65 loyal dealers.

- The Packaging Industry, representing 55% of paper consumption, is growing rapidly, with West Coast Paper Mills as a key player.

- The stock recently broke out from a consolidation zone, indicating potential for a significant rally.

- India has become a net exporter of paper in the last two years.

West Coast Paper addressed raw material scarcity through links with local farmers.

The company consistently invests in capital expenditures, reflecting a commitment to growth and modernization.

The company has recently completed an acquisition, acquiring "Andhra Paper Mills," which has further strengthened its position as a leader in the paper industry.

Let's conduct our "EICT Analysis" and assess whether West Coast Paper, the industry leader, is investible or not.

Understanding the Macros

Tailwinds(What’s in favour?)

Why did we consider picking a stock from this sector?

India's per capita paper usage is only about 15 kg, which is significantly lower than the global average of 57 kg. This suggests there's plenty of room for paper consumption to grow in India, driven by factors like economic growth, education, and changes in our lifestyles. In fact, India contributes nearly 5% of the world's total paper production.

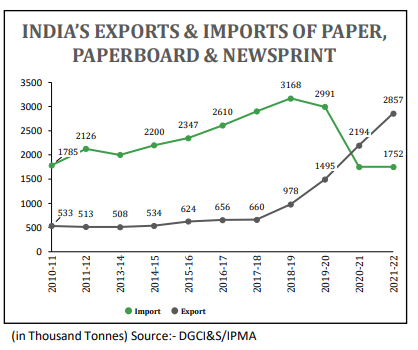

Furthermore, there has been an impressive 80% increase in exports compared to the previous year, leading to two consecutive years where our exports have exceeded imports. This shift indicates a favourable trade balance.

The rise of the E-commerce industry and the growing demand for packaging in fast-moving consumer goods (FMCG) and healthcare products are contributing to the thriving paper packaging production sector in India, which is expanding at a steady rate of 9-10% annually.

What's more? All the paper companies in India are currently in an expansion phase, having recently undertaken substantial expansions due to strong domestic and global demand. As a result, India is now the fastest-growing paper market globally, driven by increasing GDP, rapid urbanization, rising literacy rates, and increased government spending on education. The country's young demographic is also contributing to this growing demand for paper products.

Headwinds: What Are the Concerns?

One pressing issue is the insufficient availability of raw materials. India faces a shortage of wood fibers, and by 2024-2025, we'll need 15 million tonnes per year, but currently, we only have 9 million tonnes available. Additionally, our waste recovery system in India is not up to par. Of all the paper we use and discard, only 38% gets recycled.

But here's a positive shift: West Coast Paper Mills used to import costly raw materials from countries like South Africa. Now, they've achieved a remarkable transformation through a strategy called "Backward Integration." Instead of relying on external sources, they're producing 100% of their raw materials domestically. They've accomplished this by cultivating their own 2,463 acres of land and assisting other farmers in setting up plantations.

Analysing the Sector

Before we dive deeper into the company's business and finances, let's explore the growth potential of the Indian paper industry.

Have you ever wondered why we use so little paper in India?

We are the 15th largest producer of paper globally, with a 5% market share in paper production, and our paper consumption is just 4.7% of global consumption. Surprisingly, India boasts the fastest-growing paper market in the world, even though our per capita paper consumption is a mere 15kg compared to the global average of 57kg. This is primarily due to lower literacy rates, increased use of plastics, and certain habits. However, the tide is turning, and we've witnessed robust growth in recent years.

When you think of a paper company, do you immediately picture writing or printing paper? Well, think again. The highest paper consumption in India isn't for writing or printing but for paper corrugated boards and carton boards used in packaging. Take a look at the chart below, which illustrates India's paper consumption patterns.

Although growth is evident across all sectors, the Packaging Industry stands out as the driving force, boasting an impressive 9.08% growth rate last year (source: IPMAINDIA), and it's poised to maintain this momentum.

For the paper industry, raw material and water availability pose significant challenges. However, companies strategically located, like West Coast Paper Mill's "Dandeli" plant, gain a competitive advantage, fueling the company's growth.

Taking a peek at the export-import data on IPMAIndia's website (Indian Paper Manufacturer's Association), India has consistently been an exporter, surpassing imports for two consecutive years. Notably, newsprints are a major import category, while we shine as net exporters in the paper and paperboard segment. Our chosen company, "West Coast Paper Mills," primarily focuses on paper and paperboard products.

Yet, our domestic demand is robust, with India consuming 4,307 thousand tonnes out of the 4,824 thousand tonnes produced last year, leaving the remainder for exports.

The most notable growth rates were observed in three categories: packaging board (~10%), cup stock (13%), and tissue (14%). West Coast Paper Mills plays a significant role in the packaging board and cup stock segments.

It's quite a challenge for new businesses to break into this industry, so most of the competition will involve just a handful of top players. Achieving economies of scale and securing enough water resources while upholding environmental standards can be quite a task. Slowly but surely, the big players are reducing competition by acquiring and merging with others. The West Coast Paper Mill's acquisition of Andhra Paper is a prime example of this trend.

Now, let's analyze the company's business and its financials to see if it's worth investing in.

Understanding WESCO’s Business

As a framework for our company analysis, we do ask ourselves a few questions and try to get the answers.

What is the Core business of the company and the revenue mix?

First, we look at the core of the company's business and how they make their money. It turns out that a whopping 96% of their revenue comes from the paper and paperboard business, with the remaining 4% coming from their optical fiber cables division. In the paper and paperboard segment, they offer a diverse range of products like writing and printing papers, packaging papers, cup stocks, and some high-margin premium items.

They're quite efficient in their production, boasting a 98% capacity utilization rate, and they've consistently kept it above 90%. Their focus on reducing raw material costs in their core operations has paid off, thanks to strategies like plantation initiatives and support for local farming communities.

They're pretty self-reliant too, having surplus resources in three critical areas: water, power, and steam.

Now, how did they manage to lower their production costs?

Well, it's impressive. They used to import pricey wood chips from other countries, but now they source domestically, saving big bucks. They've also kept their power costs in check with their very own captive power plant. Plus, they've continuously upgraded their machines for better operational efficiency and productivity.

Let's talk about their Capital investments.

They're not shy about capital expenditures. Over the years, they've consistently expanded their production capacity. For instance, in 2010, they invested a whopping 1450 crores, and the trend continued with investments of 149 crores in 2017-2018, 161 crores in 2018-2019, and 283 crores in 2020-2023. A significant portion of these investments has gone into upgrading their machinery technology.

The business moat or competitive advantage?

They have a robust distribution network with over 65 dealers, and an impressive 75% of them have been loyal partners for the past 15 years. Their strategic location in Dandeli provides them with abundant water from the Kali River, and their self-sustained power plant ensures a steady power supply. These factors give them a significant competitive advantage over their rivals.

Promoters stake has increased!!

Their stake has steadily increased from 52.4% in 2012 to 56.53% in 2023, a clear sign of their confidence in the company's prospects.

Financial Analysis

Revenue and net profit growth

Take a look at the table showcasing the impressive growth of West Coast Papers. Over the past five years, they've achieved a remarkable 24% increase in sales and a substantial 34% growth in net profits.

We generally prefer to invest in companies whose sales and profit growth is above 15%. The growth in numbers seems very impressive with the growing demand for papers in India.

Moreover, both their paper and cable businesses have displayed growth in revenue, showcasing their overall success."

Debt Check-Strong Balance Sheet

Over the past five years, the company has generated nearly 200 crores in free cash flow, which it can now use to support its future expansions both in India and abroad, all without needing to borrow money. As shown in the chart, the company has significantly lowered its debt levels over time. Currently, the debt-to-equity ratio stands at a mere 0.07.

Cash Flow from Operations

We always aim to find companies with a steadily increasing cash flow from their core operations, as it demonstrates the company's ability to make real money from its primary business.

Profitability of the Company

Personally, I prefer investing in companies with strong financial performance. Return on Equity (ROE) tells us how well a company uses its shareholders' money, and Return on Capital Employed (ROCE) shows how effectively it uses all its invested capital.

Considering West Coast Paper, they have an impressive ROE of 30.74% and a remarkable ROCE of 50.78%. These numbers outshine their tough competitors like JK Paper and Seshasayee Paper & Boards Ltd. West Coast Paper is clearly doing exceptionally well in terms of profitability and capital utilization.

Valuation

The stock has a Price-to-Earnings (PE) ratio of 4.37, and its competitor, JK Paper, stands at a PE multiple of 5.19. However, when you consider the company's recent sales and profit growth rates over the past few years, it appears that both the stock and the paper industry are undervalued.

Risks and Concerns

We see a big risk in not having enough wood for making paper with the rising paper demand in India. However, West Coast Paper Mills has solved this problem by getting all their wood from within the country. It's interesting to see how they'll keep it up.

Technical Tadka

So far, we've explored the basics of analyzing the paper industry and making investments. Now, let's dive into what the technical charts are telling us!

Up there, you'll find the chart displayed in a weekly time frame. What's interesting is that the stock is currently trading above its 200-day Exponential Moving Average (EMA). Take a look at that Darvas box breakout on the chart. This occurs when a stock has been tightly consolidating for an extended period and then suddenly breaks out of that zone. With paper stocks starting to trend up once more, this breakout could potentially lead to some significant gains in the stock.

Disclaimer:-

We are not a SEBI-registered Investment Advisor. This is not a recommendation but only a case of sample analysis that might help you to do fundamental research on various companies.

Conclusion

Considering the strong domestic demand for paper and the potential for India's per capita consumption to increase from 15kg (well below the global average of 57kg), we are highly optimistic about the Indian paper industry. Among the stocks we've assessed, West Coast Paper stands out due to its advantageous location, robust distribution network, cost-saving efforts through in-house raw material production, and a promising technical chart that indicates a breakout from a consolidation zone. Therefore, we have identified West Coast Paper as a promising investment opportunity

View:- Long Term

CMP(Current Market Price):- 668.10

Target Price:- 1000 and above

| Broker | Type | Offerings | Invest |

|---|---|---|---|

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Service Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |