Tomorrow's Opportunities: Futuristic Investment Sectors in India

In Chaotic 2021-2022, the market was abuzz with the USA banning China for using forced labor of the Uyghur community, terming it a genocide. Uyghurs, mostly Muslims with a different culture and language from the majority of Chinese people, have faced persecution by the Chinese government. This geopolitical maneuver, however, didn't just reverberate through diplomatic channels; it opened a gateway for new opportunities in the Indian market. This led to high demand shift to some Indian sectors like Chemicals, Papers, textiles, etc.

The driving forces behind opportunities in a sector are diverse, such as consumer preferences, technological innovations, regulatory bans or push, demographic trends, and addressing market gaps. Some experts recommend identifying sectors with opportunities by examining where China is not focusing, and India is experiencing growth.

How did Indian Stock Market became so resilient amidst macro shocks and global uncertainties? Where do investors see an opportunity? As an investor, it always comes to mind, which sector is going to grow for a long time? Which sectoral theme should we play in MF investing or in stock baskets?

In this article, we will try to discuss some such sectors that have the future potential to generate alpha. However, recognizing that the potential for growth is one aspect, while acquiring them at reasonable valuations is another. Purchasing a company from an outperforming sector at high valuations may not yield returns when reality sets in. It is challenging to generate alpha from an industry or company that is widely popular and in everyone's focus. Therefore, focusing on under-researched companies may be crucial.

We all know electric vehicles will revolutionize the mobility space, but the EV stocks are so expensive, where we may not get an entry with lower valuations. But we can enter in ancillary sectors that support EV like battery segments, charging stations. Likewise, in the paint industry, Asian Paints, Berger Paints used to be the leaders, but with JSW Paint coming and doing 35,000 crores of capex, it will create a very big price war. It may happen that evergreen stocks may not stay evergreen forever with increasing competition.

Sectors with promising prospects…

Manufacturing Sector - Textile, Paper, Defence & Chemical:

Companies are relocating from China to India, with Apple shifting its manufacturing operations to cater to 50% of global demand. The Production Linked Incentive (PLI) scheme incentivizes manufacturers in key sectors, offering financial rewards based on incremental sales and investment.

India is progressing towards becoming a net defense exporter through indigenous development (Atmanirbhar Bharat). In 2022, defense exports surged tenfold to almost 16000 crores. Drones, hand grenades, high precision instruments, guns, and carbines have all experienced growth. Countries in the Middle East and South Asia are procuring missiles, radars, and simulators, and India is securing air defense contracts worldwide.

Solar Industries, initially an explosives company, has diversified into hand grenades and Pinaka rockets, excelling in these fields. Some defense companies derive more revenue from services than products. Solar Industries getting orders from Armenia, Nigeria and eyeing Indonesia.

In the paper industry, optimism stems from the boards and packaging sector's potential growth due to the burgeoning e-commerce industry & paper ban. Despite India's per capita paper usage being only 15 kg, significantly below the global average of 57 kg, the country has transformed into a net exporter from an importer.

The textile segment is witnessing growth, with India engaging in numerous Free Trade Agreements. The ban on Chinese imports by the USA positions India, the largest cotton producer, to capitalize on global demand. Government initiatives aim to boost the fabric segment through capital expenditure. .GokulDas, KPR Mill-like companies are doing good. Textile sector is the second-largest employer after agro, so the government can't ignore. In bed sheets, we have captured 55% market share in the world but not in the apparel segment.

Chemicals and Specialty Chemicals see a shifting trend as China's dominance wanes. Companies like Deepak Nitrite, Navin Fluorine, and Pi Industries are capitalizing on this evolving market.

Financial Sector in India:

Over the last decade, the financial sector has experienced significant inclusion, bringing over 50 crore people into the formal banking system through Jan Dhan Yojana. Private banks, historically boasting the lowest NPAs, contrast with undervalued PSU Banks. Despite this growth, Indian banks are far from the top 10 globally in terms of asset size.Investing in banks can be tricky, and we have to find the banks that do responsible lending, not aggressive lending.

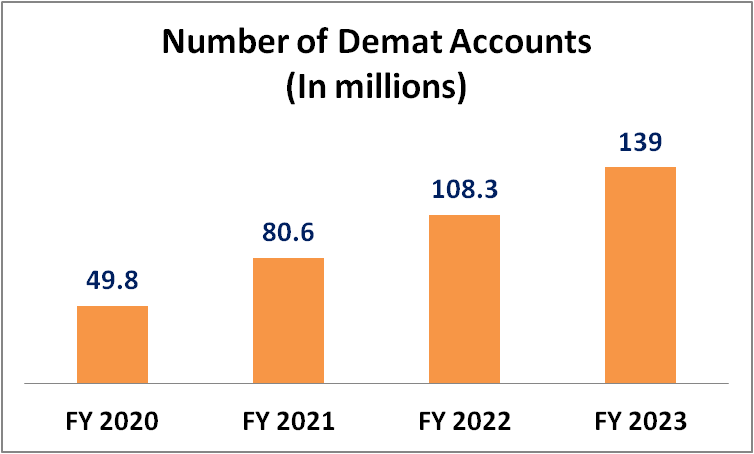

The broking industry has witnessed a surge in demat accounts, with a doubling of account openings in 2021. Depositories and asset management companies, including CDSL, have generated robust returns.

Clean energy, Digital Infrastructure:

Technological and digital solutions characterize the clean energy and digital infrastructure sectors. Notably, Tata Power has gained prominence in EV charging. The tech-driven evolution in mobility is evident, with Tata Elxsi and KPIT developing software for cars and catering to aerospace companies like Boeing and Airbus. The software cost in cars in India has moved from 10% to 25% and is constantly increasing.

Food consumption & QSR sector:

Once there was a time tea and coffee used to be sold in unpackaged, and now one will not see any unpackaged tea and coffee.The unorganized nature of the food consumption market in India, evident in the sale of unpackaged dal, chawal, atta, is undergoing rapid transformation. With an unorganized market space of 1.8 lakh crore and organized space at only 10k crore, there is immense potential.

The eating behavior is also changing; people want to go out and eat or order online. Changing eating behaviors, increased online orders, and a rise in Quick Service Restaurants (QSR) indicate rising per capita consumption, offering opportunities for growth. While FMCG remains a defensive sector, long-term growth prospects make QSR a viable choice. Examples include Devyani International and Zomato.

Disclaimer😑

"We are not a SEBI registered advisor, and this should be considered as a research case study only."