Capital Market Line (CML)

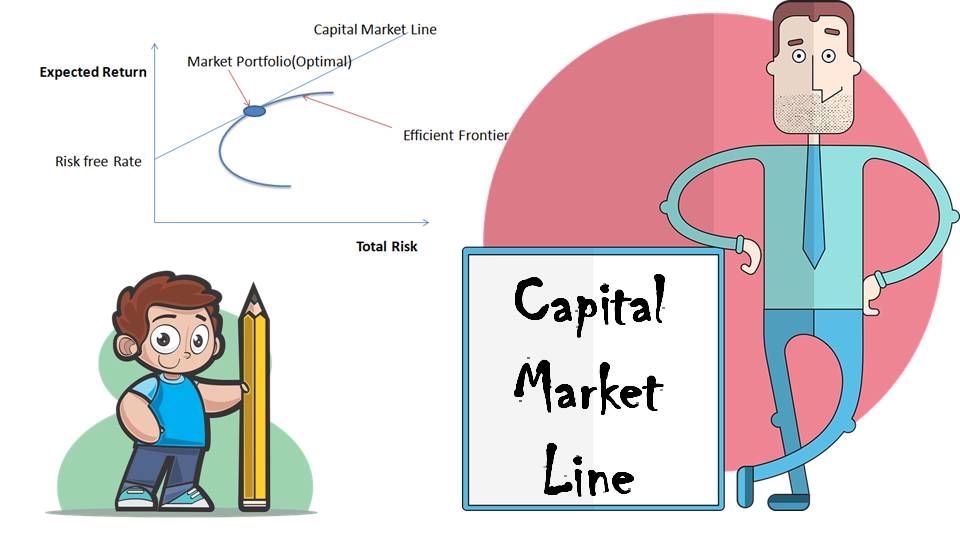

The Capital Market Line (CML) is a graphical representation of the relationship between risk and return for an efficient portfolio of risky assets. CML is used to help investors determine the expected return and risk of an efficient portfolio that combines a risk-free asset with a portfolio of risky assets. It is line connected to Risk free Rate and Optimal Portfolio(Market portfolio in the figure).

The Equation of Capital Market Line:-

The Capital Market Line (CML) is a linear relationship between the expected return and risk of a portfolio that is comprised of a risk-free asset and a risky asset. The formula for the Capital Market Line is

where:

E(Rp) is the expected return of the portfolio

Rf is the risk-free rate of return

Rm is the expected return of the market portfolio

σp is the standard deviation(Risk) of the portfolio's returns

σm is the standard deviation(Risk) of the market portfolio's returns

Illustration with an Example:-

let's consider an example. Suppose an investor has the option to invest in two assets: Stock A and Stock B. The investor believes that Stock A has an expected return of 10% and a standard deviation of 20%, while Stock B has an expected return of 15% and a standard deviation of 30%.

The investor wants to construct an efficient portfolio that combines these two assets. To do so, the investor needs to determine the optimal combination of Stock A and Stock B that maximises the expected return for a given level of risk.

To construct an efficient portfolio, the investor needs to calculate the expected return and risk of various portfolios that combine different proportions of Stock A and Stock B. The optimal portfolio is the one that maximises the expected return for a given level of risk or minimises the risk for a given level of expected return. We have considered Market Portfolio in the image as the Optimal Portfolio.

Once the optimal portfolio is determined, the investor can use CML to plot the expected return and risk of the efficient portfolio. CML is a straight line that connects the risk-free rate of return to the optimal portfolio of risky assets, where the portfolio's expected return is maximized for a given level of risk.

For example, suppose the risk-free rate of return is 5%. The optimal portfolio of Stock A and Stock B has an expected return of 12% and a standard deviation of 25%. Using CML, the investor can plot the expected return and risk of the efficient portfolio as a point on the line connecting the risk-free rate of return to the optimal portfolio.

Difference Between CML and SML

The Capital Market Line (CML) and Security Market Line (SML) are two important concepts in finance that are used to assess the risk and return of investment portfolios.

The key difference between CML and SML in terms of risk is that CML measures both systematic and unsystematic risk, while SML measures only systematic risk.

CML is used to measure the total risk of a portfolio, which includes both systematic risk and unsystematic risk. Systematic risk is the risk that cannot be diversified away and is related to the overall market, while unsystematic risk is the risk that can be diversified away and is related to specific assets or industries.

On the other hand, SML measures only systematic risk, which is also known as market risk. It is the risk that is inherent in the market as a whole and affects all securities in the market. SML is a graphical representation of the relationship between the expected return and systematic risk of an asset or portfolio.

Key Takeaways

- CML helps investors determine the expected return and risk of an efficient portfolio that combines a risk-free asset with a portfolio of risky assets.

- The formula for CML is E(Rp) = Rf + [Rm - Rf] x (σp/σm).

- CML is a straight line that connects the risk-free rate of return to the optimal portfolio of risky assets, where the portfolio's expected return is maximized for a given level of risk.

- The slope of the CML represents the market risk premium, which is the additional return an investor expects to earn by taking on market risk.

- The optimal portfolio and market portfolio are not the same, as the former is tailored to an individual's specific risk and return preferences while the latter contains all available assets in the market, weighted according to their market values.