Union Budget 2026: Can India Sustain Its Goldilocks Growth?

As India heads into Union Budget 2026, to be presented by Hon’ble Finance Minister Nirmala Sitharaman for a record ninth consecutive time, the budget assumes historical significance and is expected to outline key reform measures to sustain growth amid a weakening global and geopolitical landscape. The RBI Governor has said that FY26 was a Goldilocks period for India, as it refers to a rare combination of high growth and unexpectedly low inflation during this period. In numerical terms, the economy grew at a rate of 7–7.5% and inflation remained as low as 2%. This historically low inflation can trigger many money flow decisions in this budget. For this, I would suggest you understand the famous economist Ray Dalio’s video, How the Economic Machine Works. In such low inflation scenarios, central banks infuse more money into the economy.

After this unexpected year of resilient growth, strong demand, and good rural outcomes, what lies ahead in the new financial year? Can we sustain this growth considering external challenges such as the depreciating rupee (testing ₹91–92 per USD) and looming geopolitical tensions? Or is it possible that policymakers are comfortable because there are other headwinds like rupee depreciation already factored in?

Key Factors That Will Impact Budget 2026 Decisions

- Macroeconomic Conditions: GDP growth, inflation trends, and RBI’s monetary policy stance will shape the overall fiscal strategy.

- Currency & External Pressures: A weakening rupee and current account dynamics may limit aggressive fiscal expansion.

- Geopolitical Risks: Global conflicts and oil price volatility can influence subsidy and defence allocations.

- Fiscal Discipline: Government borrowing and deficit targets will constrain large populist spending.

- Infrastructure Push: Continued focus on capex and asset monetisation to sustain long-term growth.

- Private Investment: FDI inflows and corporate capex cycles will guide policy incentives.

Let’s first see where we stand with government borrowings. Our borrowings are rising gradually, mainly due to the refinancing of older debt as well as funding infrastructure. In FY26, net borrowings remain around ₹11.54 lakh crore, which is after the repayment of old debt and is aligned with the 4.4% GDP fiscal deficit target. How do borrowings from institutions like the IMF or the World Bank impact policy decisions? In the upcoming FY27, borrowings are expected to rise slightly to around ₹11.7 lakh crore, as we are a growing nation and need to borrow both for refinancing older debt and for capital expenditure on building infrastructure.

Government capital expenditure has emerged as the central pillar of India’s growth strategy. In FY2024–25, capital expenditure stood at around ₹10.2 lakh crore, which was increased to ₹11.2 lakh crore in FY2025–26, reflecting a year-on-year growth of nearly 10%. Is this 10% growth reasonable? When China was at a similar stage, it was growing in double digits. Then what is the right rate at which we need to grow to reach closer to China? Unfortunately, some economists say that the government has been giving too many subsidies and freebies. Do we need a change in approach? For FY2026–27, market estimates suggest that the government could push capex beyond ₹12 lakh crore, maintaining its commitment to infrastructure-led growth. This expansion is expected to be financed through a combination of higher budgetary allocation, interest-free long-term loans to states, asset monetisation, and increased private sector participation. If this happens, it could act as a catalyst for sectors like real estate, infrastructure, and housing materials.

Sectoral Outlook

Defence:

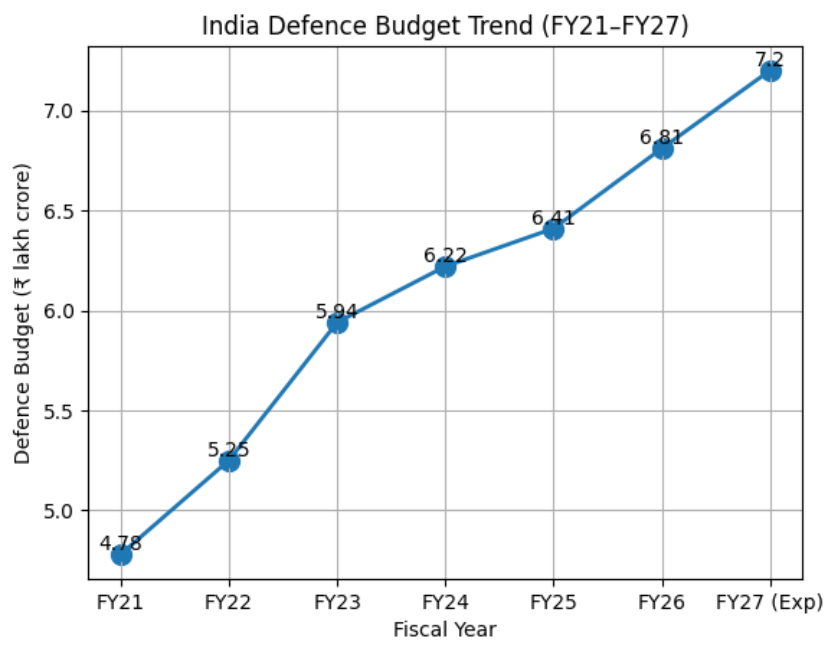

For the past few years, you may have noticed that right before the budget, defence stocks start rising sharply. Why is this so? India spends around 2.23%, which is roughly USD 93 billion. Over the last five years, India’s defence budget has followed an upward trajectory. Spending rose from ₹4.78 lakh crore in FY21 to ₹6.81 lakh crore in FY26 and is expected to cross ₹7 lakh crore in FY27, with a growth rate of nearly 7%.

Is this defence budget enough when compared with other nations? Global data shows the United States spends by far the most on defence — close to $900+ billion — while China spends around $331 billion (often around triple India’s total). In percentage terms, China’s defence spend has often been around 1.7% of GDP.

Amid rising geopolitical tensions globally, defence remains a critical area for the government. While India’s defence spending is growing steadily and reflects policy priorities, reaching anywhere near the scale of the US or China would require much higher absolute spending and faster growth. Given the vast differences in economic size, population, and strategic commitments, direct comparisons are difficult, and a focus on efficient modernisation may matter more than simply matching another country’s percentage growth.

Subsidy:

Subsidies are a safety net, not a growth engine. Yet again, the government is planning to deploy around ₹4.25 lakh crore, which is similar to last year. Ideally, these subsidies are given by the government to help people stand on their own feet, not to stay dependent forever. The real question is whether the money is actually reaching the needy and for how long the government should continue giving free money. Economists generally follow four golden rules for an ideal subsidy system: it should be targeted to the right people, temporary rather than permanent, directly reach the needy, and be productive in nature.

Agriculture:

Every year, the budget allocation for agriculture has been increasing, rising from ₹21,933 crore earlier to over ₹1.27 lakh crore today. That is a significant expansion. If you see the country’s GDP like a business, you would deploy capital in segments that contribute more to the business, right? Similarly, this expansion is necessary because agriculture supports nearly half of the population but contributes only about 18% to GDP. The real question is whether this capital expenditure is enough and how efficiently it is being used. Spending more on agriculture makes sense, but how the money is spent matters more than how much is spent. Today, the government is mainly protecting farmers from losses, whereas it should also focus on helping them earn more efficiently. So increasing the budget is important, but where and how the money is spent is even more critical.

Healthcare:

One question you need to ask yourself is: if you were diagnosed with a serious illness and immediately needed surgery, would you choose a government hospital or a private hospital? If you choose a private hospital, you may end up losing your entire life savings in one go. Due to high taxes on medical equipment, surgeries become expensive. No wonder healthcare is considered expensive in India. Public healthcare spending in India is only around 2% of GDP, whereas global standards are closer to 5%. Experts suggest that even increasing this to 3% of GDP would bring significant improvement to the system. Although basic healthcare services are not taxed under GST, healthcare remains expensive because only life-saving drugs are taxed at 0–5%, while most medicines, equipment, and health insurance attract 12–18% GST. These costs are ultimately passed on to patients.

In the end, Budget will be remembered not for how much the government spends, but for how effectively it converts growth into long-term economic strength.