How the Depreciating Rupee Impacts the Economy, Daily Life, and Investments

Why does the Indian rupee often move in line with other emerging market currencies rather than reacting only to domestic economic stress?

How might currency movements impact the cost of pursuing higher education abroad in the coming years?

And what is the long-term opportunity cost of investing solely in a developing economy like India, versus having exposure to more mature markets such as the US?

To answer these questions, it is important to first understand how the rupee actually behaves and what truly drives its movement over time.

Over the years, the Indian rupee has faced periodic depreciation pressure against the US dollar. While this is often attributed to domestic factors, a closer look at historical data suggests that the rupee’s movement is influenced just as much by broader global forces — including trends across emerging market currencies, global monetary conditions, trade imbalances, and the persistent demand for safe-haven assets like the US dollar.

Dollar strength and global market dynamics

The first and foremost reason for the Indian rupee declining remains the same and is the sustained strength of the US dollar. As a part of the global standardized medium of exchange or global dominant reserve currency, it is the only currency that appreciated even during times of global crises, as the US market provides expectations of higher interest rates in the long term, which boosted the demand for dollar-dominated assets (investments that are priced, traded, or generate returns primarily in US dollars). This led to disinvestment in the Indian market.

“Currency analysts point out that the rupee’s weakness is more a reflection of global dollar dominance than any sharp deterioration in India’s economic fundamentals.”

Looking at interest rates, higher interest rates in the US have increased the yield difference between US and Indian assets. This attracts global investors to allocate funds towards US bonds and treasuries, as they are comparatively considered safer and offer attractive returns in a high-rate environment.

If we take a look at India’s trade deficit and import dependencies, its structural trade deficiencies continue to weigh on the country. The country is more dependent on imports of crude oil, gold, and electronic goods (here we will try to get numbers of imports and exports from the Ministry of Statistics), most of which are priced in US dollars. Higher import bills lead to increased dollar demand, expanding the current account deficit, and exerting downward pressure on the rupee.

Rising global crude oil prices further impact the rupee. As India imports nearly 85 percent of its oil requirements, higher energy prices directly increase dollar outflows. Market experts note that oil price movements remain one of the most critical external variables impacting the rupee’s direction.

Foreign investors have been investing unevenly because they are highly sensitive to global conditions. When global markets become volatile and interest rates abroad rise, they suddenly start disinvesting in the Indian market. This leads to money moving out of India, increasing demand for US dollars. As a result, the rupee weakens.

Steady Depreciation of the Indian Rupee Against the US Dollar (2010–2025)

The graph highlights a clear long-term weakening of the rupee against the US dollar. The exchange rate has moved from around ₹45 per dollar in 2010 to nearly ₹90 per dollar in 2025, showing a steady upward trend over time. Although there are short phases of stability and minor pullbacks, the overall pattern reflects a consistent and gradual depreciation of the rupee, with each period of consolidation followed by a move to a higher level.

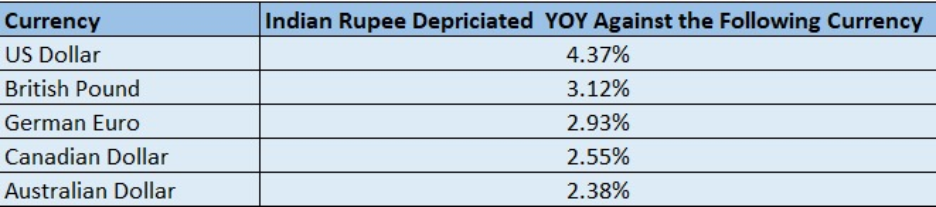

Year-on-Year Depreciation of the Indian Rupee Against Major Global Currencies

The table highlights the year-on-year depreciation of the Indian Rupee against major global currencies. The steepest decline is seen against the US Dollar at 4.37%, indicating strong pressure from global dollar strength. Depreciation against the British Pound and the Euro remains moderate at just over 3% and 2.9% respectively. Among the listed currencies, the Rupee weakened the least against the Australian Dollar, reflecting relatively better stability in that exchange rate.

Economists emphasize that slight currency depreciation is common for fast-growing emerging economies like India, which require regular inflows of foreign capital and imports of technology and energy. In this context, a gradually weakening rupee is viewed as a structural outcome of growth dynamics rather than a sign of economic instability.

Taking the example of a two-year course, the fee increased from USD 45,000 in 2010 to USD 120,000 in 2025, implying an annual growth rate of 6.3 percent in dollar terms.

However, when these fees are viewed from an Indian rupee perspective, the impact is significantly higher. In 2010, the same USD 45,000 translated to ₹20.25 lakh at an exchange rate of ₹45/USD. By 2025, USD 120,000 converts to ₹1.08 crore at an exchange rate of ₹90/USD, reflecting an effective annual increase of 11.1 percent in rupee terms.

In comparison, Indian college fees rose from ₹7 lakh in 2010 to ₹21 lakh in 2025, representing an annual inflation of about 7.1 percent. This indicates that, in local terms, education cost inflation within India has remained broadly aligned with general cost escalation.

The key takeaway is the impact of rupee depreciation. While the underlying dollar-denominated education cost grew at a moderate pace, the weakening of the Indian rupee nearly doubled the effective inflation for Indian students funding overseas education. For individuals earning in rupees but spending in dollars, the real cost escalation works out to nearly 11.1 percent per annum, primarily driven by currency depreciation rather than fee inflation alone.

Going forward, the rupee’s direction is expected to remain closely linked to global factors such as US monetary policy, crude oil prices, and risk sentiment. While near-term volatility may persist, analysts believe that India’s strong growth outlook and adequate foreign exchange reserves provide a buffer against sharp currency movements.

For investors, experts advise focusing on long-term fundamentals and portfolio diversification rather than reacting to short-term currency fluctuations.