How India's Investors Made the Market Move Before RBI Even Cut Rates?

In Short

- Markets often move ahead of policy announcements as investors position themselves based on expectations rather than actual decisions.

- Anticipation of interest rate cuts increases risk appetite, leading to early inflows into equities and equity-oriented funds.

- Falling bond yields and stable inflation trends encourage investors to shift allocations from fixed-income instruments to capital markets.

- Mutual fund inflows and institutional activity often reflect confidence in future growth before monetary easing actually begins.

- When policy moves are widely expected, markets may show limited reaction on announcement day as gains are already priced in.

- Investor behaviour, liquidity conditions, and expectations together play a key role in driving pre-policy market momentum.

The RBI Rate Cut: A Headline or a Sideshow?

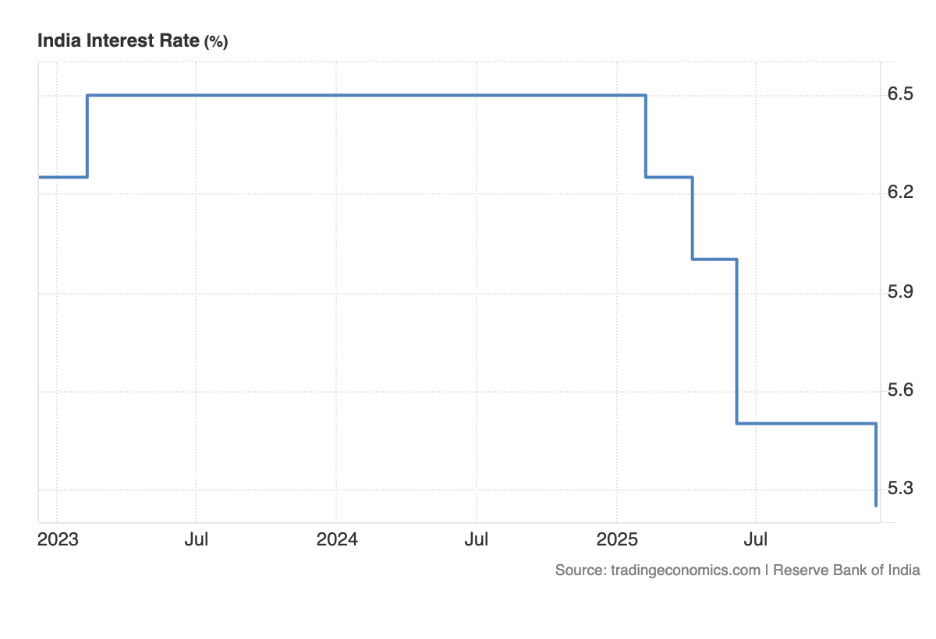

The Reserve Bank of India's rate cuts have become the season's hottest headline. Every percentage point reduction triggers a rush for analysis. "Will equities finally rally?" "Are we at a turning point?" Or is it an illusion? Yet beneath this noise lies a more compelling story-one where Indian markets have already made their move, independent of policy cycles.

The real headline isn't about what RBI will do next. It's about what Indian domestic investors have already done.

When policy rates began to shrink from 6.5% in 2024 toward 5.5% by mid 2025, investors widely anticipated a sharp stock market rally. Traditional economic theory supported this view-When borrowing becomes cheaper, companies can earn more profit, their value can rise, and stock prices can go up. The script seemed predictable.

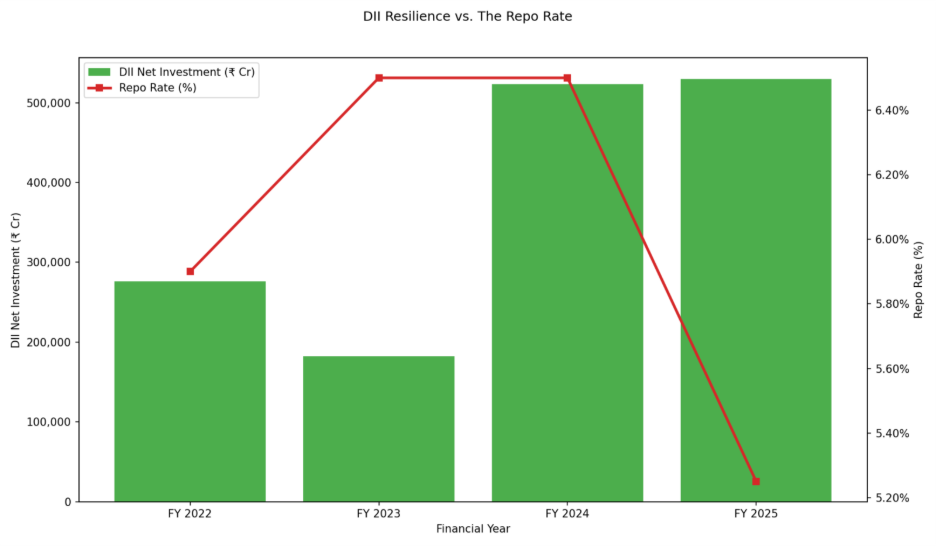

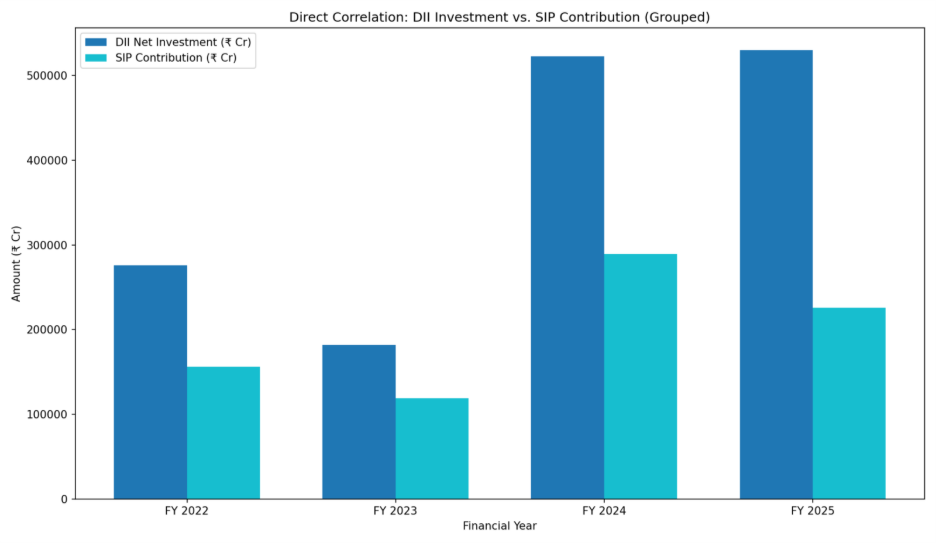

But there is an unexpected fact. Massive domestic institutional investor (DII) inflows began speeding up in 2024 before any rate cuts were announced. While global markets were pricing in extended monetary tightness, Indian mutual fund managers, insurance companies, and pension funds were already deploying capital at record levels into Indian equities. The RBI hadn't signaled cuts. The headlines were still dominated by inflation concerns.

From Fear to Confidence: The Investor Mindset Shift Since 2022

Over the last three years, Indian investors have become smarter about choosing where to put their money. This change started in 2022 when the RBI made borrowing more expensive to fight inflation. Even though interest rates were raised to 4.4%, it wasn't enough to control rising prices, so the RBI kept raising rates further. Indian investors got scared by these rising interest rates and started pulling their money out of the stock market. This was a smart move at the time because the economic situation was uncertain and risky.

2023 was a "wait and watch" year. There's a peculiar moment in Indian financial markets when patience becomes the most rational choice. The numbers told a conflicting story. Inflation was softening. But the RBI's projections warned it would remain elevated through at least the second quarter. The central bank kept rates at 6.5%, refusing to blink—a sign that monetary tightening wasn't finished. The stock market moved a little bit, but it felt like it was walking uphill slowly. There was no excitement or rush from regular investors to buy stocks.

Why 2024 Marked a Turning Point for Indian Markets?

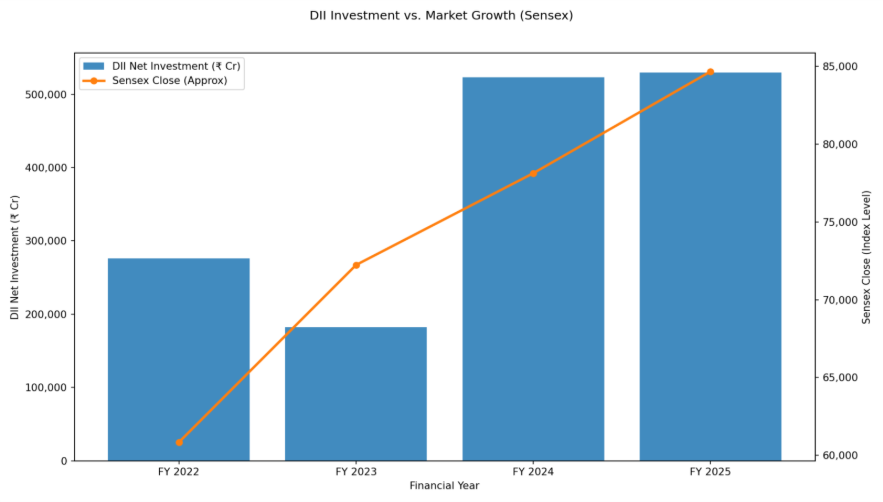

2024 brought hopes back to Indian markets. Even though interest rates were still high and the RBI wasn't making borrowing cheaper, something changed. Indian investors started believing in the stock market again. Regular people began investing through mutual funds; insurance companies started putting money into stock-linked products, and pension fund managers started investing for the long term. These investors weren't waiting for the RBI to cut interest rates. Instead, they saw a clear opportunity where inflation was under control, companies were making good profits, and India's economy was ready to grow.

Companies that were already growing could now do so with even lower capital costs. Indian investors did their homework in 2024, even before interest rates came down. They looked at the company's quarterly results. They studied balance sheets to understand how healthy companies were. They figured out that Indian companies were about to earn much more money. When the RBI finally cut interest rates, it was just the cherry on top.

Mutual Funds and Pension Plans: The New Market Movers

For a long time, big foreign investors and huge institutions controlled the stock market. But that's changing. Mutual funds have grown massively, Between March 2022 and November 2025, mutual fund assets under management (AUM) exploded from ₹37.5 lakh crore to ₹80.80 lakh crore—a breathtaking 115% growth in just 3.5 years. This represents the addition of ₹43.3 lakh crore of new capital flowing into Indian markets from domestic investors and More people are buying pension plans. Insurance products are easier to understand and buy. Apps and websites now make it simple for anyone to invest.

This means millions of everyday Indians, not just the rich or big players are now deciding where to put their money. These regular investors were looking at the long-term picture for investing. They're not buying and selling stocks based on daily news headlines. They're thinking about their future savings for the next 3, 5, or even 10 years. They're building their wealth slowly and steadily. For years, when the RBI changed interest rates, foreign investors would pull their money out, and the market would crash. Not anymore. Now that Indian families, through mutual funds and pension plans, own most of the stocks, things are different. These investors don't panic when rates change. They believe in Indian companies and stay invested for the long term. So, the market stays stronger, even when there's bad news.

The RBI's next interest rate cut will help the economy. But here's the real question: what if rate cuts don't happen? Will the Bull Market Survive Without More Rate Cuts?

The Answer Is Yes. Because Indian investors believe in Indian companies making good profits, the stock market would still grow—just maybe not as fast. Lower interest rates would speed things up, but they're not the only reason the market will do well.