A 360° Analysis of Flexi Cap Mutual Funds

Mutual funds have long been a trusted tool for wealth creation, especially in the dynamic world of equity investing. Among them, Flexi Cap mutual funds stand out for their flexibility and adaptability. These funds allow fund managers to invest across large-, mid-, and small-cap stocks without any allocation restriction, enabling them to seize market opportunities as they arise.

In this article, we conduct a 360-degree analysis of five of India’s best-performing Flexi Cap funds—Quant, JM, Franklin India, Kotak, and Motilal Oswal. Using key metrics like returns, risk ratios, fund size, expense ratios and market cap allocations, we aim to provide investors with a clear, comparative guide to selecting the fund that best aligns with their risk appetite and long-term financial goals.

In Short

- Focused on Affordable Housing: Caters to first-time homebuyers in Tier 2/3 cities, with an average loan size of ₹11.5–11.6 lakh, mostly salaried borrowers.

- Strong Growth Metrics: FY25 AUM grew 31.1% YoY to ₹12,712 Cr; net profit at ₹382.1 Cr with ROE of ~16.5% and RoA of 3.5%.

- Tech-Driven Efficiency: 91% loans approved within 48 hours, 95% customers use the mobile app, over 70% loans processed digitally.

- Robust Asset Quality: GNPA at 1.7%, low delinquencies, strong provisioning, and prudent underwriting practices.

- Premium Valuation: Trades at ~38× P/E and ~5× P/B, higher than peers Aavas and Aptus, reflecting strong performance and investor confidence.

- Long-Term Potential with Caution: High growth prospects in an underpenetrated market, but rich valuation warrants careful, phased investment.

A. Fund-by-Fund Breakdown

1. Quant Flexi Cap Fund

A high-risk, high-reward fund with aggressive market positioning. It has an AUM of ₹7,209.7 crore and a relatively high expense ratio of 1.78%. It also carries the highest standard deviation (17.16) and beta (1.07) among peers—signaling elevated volatility. A Sharpe Ratio of 0.85 indicates moderate efficiency in terms of risk-adjusted returns.

2. JM Flexi Cap Fund

JM offers a more balanced profile. With ₹5,624.01 crore in AUM and a 1.77% expense ratio, it shows slightly lower volatility than Quant (beta: 0.98, standard deviation: 15.59). It also shines with the highest Sharpe Ratio (1.18), reflecting superior risk-adjusted performance.

3. Franklin India Flexi Cap Fund

The most conservative of the five, Franklin India has a large AUM of ₹18,679.3 crore and a modest expense ratio of 1.70%. It has the lowest beta (0.92) and standard deviation (13.63), making it the least volatile. Despite its cautious approach, it offers a strong Sharpe Ratio of 1.06.

4. Kotak Flexi Cap Fund

With a massive AUM of ₹52,540.73 crore, Kotak commands investor confidence. It has the lowest expense ratio (1.46%) and maintains stability with a beta of 0.93 and standard deviation of 13.89. Its Sharpe Ratio of 0.90 reflects efficient performance with low cost.

5. Motilal Oswal Flexi Cap Fund

Ideal for investors open to moderate risk for higher returns. Managing ₹13,051.17 crore in assets, it has an expense ratio of 1.72%, beta of 0.90, standard deviation of 16.05, and an impressive Sharpe Ratio of 1.10—a good balance of return and volatility.

Now that we’ve reviewed each fund individually, let’s compare their historical returns to assess performance across timeframes.

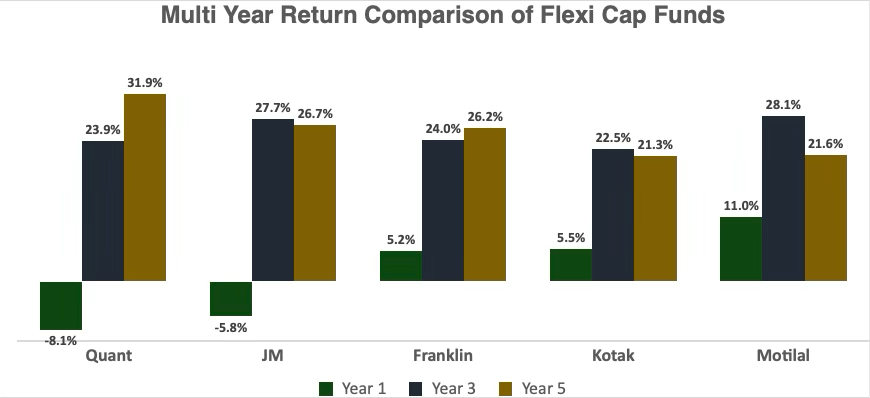

B. Comparative Returns of Flexi Cap Mutual Funds Over 1-Year, 3-Year, and 5-Year Horizons

The chart compares the returns over one, three, and five years for each of the five Flexi Cap mutual funds: Quant, JM, Franklin, Kotak, and Motilal Oswal. It tells us the following:

- Quant Flexi Cap posted the highest 5-year return (31.85%), but its 1-year return is negative (-8.10%), showing that it's highly volatile and sensitive to short-term market swings.

- Similar trends may be seen in JM Flexi Cap, which has outstanding 3- and 5-year returns (27.65%, 26.65%) but a negative 1-year return (-5.76%), suggesting recent underperformance despite earlier good momentum.

- The Franklin India Flexi Cap exhibits steady growth over the course of the three years, with particularly robust growth in years two and three.

- The most consistent performance is seen by Kotak Flexi Cap, which consistently generates positive returns despite being marginally less than its peers, underscoring its cautious approach.

- Motilal Oswal Flexi Cap maintained strong 1-year and 5-year results and had the greatest 3-year return (28.14%), indicating a more resilient and balanced development path, strong 3-year returns, though its 5-year performance dipped slightly.

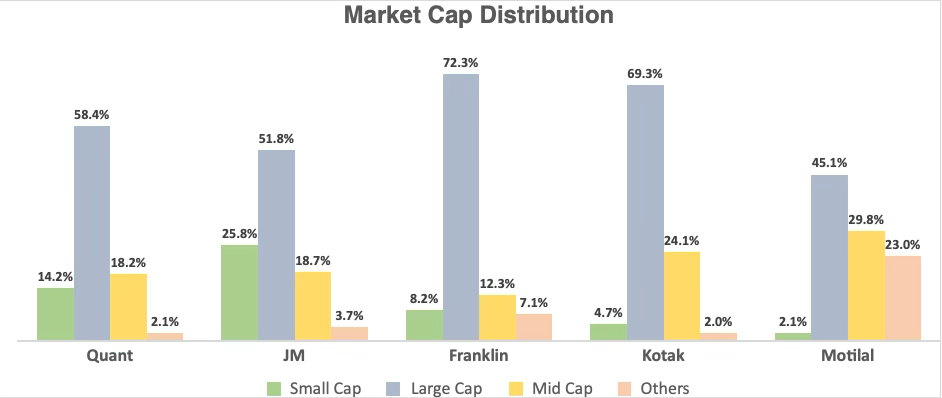

C. Market Cap Allocation Overview

The chart displays market cap allocations across five mutual funds—Quant, JM, Franklin, Kotak, and Motilal.

Franklin and Kotak lean heavily into large-cap holdings, with over 69% in that category. Motilal offers a more balanced spread, showing notable exposure to both large and mid-caps. Quant stands out with the most diversified allocation, mixing small, mid, and large caps more evenly.

D. Cost Efficiency: Expense Ratios Matter

Expense ratios can have a significant long-term impact on portfolio growth.

- Kotak Flexi Cap leads with the lowest expense ratio (1.46%), making it ideal for cost-conscious investors.

- Quant (1.78%) and JM (1.77%) are on the higher side, which may reduce net returns over time, especially when margins between fund performances are tight.

Portfolio Focus and Investor Suitability

While specific sectoral allocations weren't detailed, these Flexi Cap funds typically invest across:

- Financials

- Information Technology

- Consumer Goods

- Healthcare

- Energy

From the risk profile and market exposure:

- Quant and Motilal Oswal are aggressive, growth-oriented funds with higher small/mid-cap allocations.

- JM offers a great balance of return and stability.

- Franklin India leans conservative with low volatility and stable returns.

- Kotak is suitable for cost-conscious, long-term investors.

|

Fund |

Best For |

|

Quant Flexi Cap |

Aggressive investors seeking high returns |

|

JM Flexi Cap |

Balanced investors focused on efficiency |

|

Franklin India Flexi Cap |

Conservative, low-volatility preference |

|

Kotak Flexi Cap |

Long-term, cost-focused investors |

|

Motilal Oswal Flexi Cap |

Growth-seeking investors with risk appetite |

Conclusion: Matching Funds to Your Investment Style

Flexi Cap mutual funds offer an adaptive, diversified approach to equity investing—combining the stability of large-caps, momentum of mid-caps, and growth potential of small-caps.

Each fund in this review brings something unique:

- Quant and Motilal Oswal offer high-growth potential with greater risk.

- JM stands out for risk-adjusted returns.

- Franklin India prioritizes stability.

- Kotak excels in cost efficiency and scale.

Your choice should depend on your risk appetite, investment horizon, and cost preferences. These factors, combined with the fund’s strategy, can make a big difference in long-term outcomes.

Final Note

Before making any investment decision, consult a registered financial advisor to ensure the fund aligns with your individual financial goals, risk profile, and time horizon.

If you’re looking for flexibility, diversification, and long-term growth, a Flexi Cap fund might just be the right fit.